All Newsletters

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

eServe Newsletter June 2013

Lic's millionaire agents with bigger pay than chairman

Investors fail to renew Rs 1.9 lakh cr of insurance policies

BusinessLine | May 18, 2013

A large chunk of insurance policies from private insurers lapsed because investors didn’t pay their renewal premium, data from the IRDA’s Handbook of Statistics reveal.

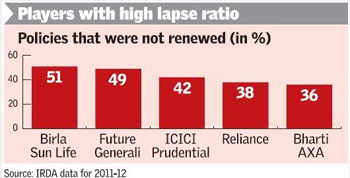

The lapse ratio was as high as 51 per cent for Birla Sun Life Insurance, 49 per cent for Future Generali and at 42 per cent and 36 per cent, respectively for ICICI Prudential and Bharti Axa Life in 2011-12.

Lapse ratio is the proportion of policies where renewal premium was not paid.

The Life Insurance Corporation has, however, maintained lapse ratios at 4-5 per cent over the last few years.

Clubbing private players and LIC, investors didn’t renew a total of 160 lakh traditional insurance plans of the value of Rs 1.9 lakh crore (total sum assured) in 2011-12, registering a two-fold jump from 2008-09. Traditional plans include term covers, endowment policies and health insurance plans. It excludes unit linked plans (ULIPs). Had ULIPs been included the lapse ratios will be even higher.

Lack commitment

The persistency ratio – the number of policyholders who stay with their policy for five years or more – is also low. A majority of private insurers saw less than half their policyholders staying on after the fifth year.

Why did so many investors not renew their insurance plans? Some insurers say this is a result of investors switching plans due to changing priorities.

Saujanya Shrivastava, Chief Marketing Officer of Bharti AXA said, "Policy lapses are high mainly in the endowment segment where the policy tenure is 10 or 15 years and people lack long term commitment because of changing priorities."

Another side to the story could be mis-selling, where agents mis-represent the product to the prospect. The Insurance Ombudsman received a total of 1.07 lakh complaints in 2011-12 on 'unfair business practices' in life policies. One-third of these policyholders complained that the product was different from what was projected.

Changing regulations that see insurers launching new products every year could

also play a role.

"Insurers keep launching new products and the message that goes to consumers

is that old products are not good enough. They then just try to cut losses and

move away (from their older plans)," says Shashwat Sharma, Partner– KPMG (India).

Where does the money go?

The next big question is – what happens to the premium

collected on lapsed policies?

When a traditional policy is discontinued after three years,

it attains paid-up status and the surrender value as agreed is

paid back to the policyholder.

However, when a buyer stops premium payments within three years, "the money is moved to reserves and carried forward for future appropriation or made available to shareholders depending on whether it is a participating or non-participating plan," says Anish P. Amin, Partner-PwC.

If ULIPs are included, the lapse ratios would be even higher. In a ULIP, if premium payment is stopped within five years, the money is transferred to a separate fund that earns token returns. At the end of the fifth year, the money is paid to the policyholder.

How much do you know about your insurance bonus

How much do you know about your insurance bonus

Your insurance policy is just not for saving tax. The bonus that accrues on your policy can also help you maximise your wealth.

Bonus is a very common term in insurance agreements. Even, an insurance seeker always has a tendency to find out a policy which offers more bonuses. A bonus is a reward or an extra amount which an individual gets over and above the sum invested (base amount) in the insurance policy. In insurance industry, bonuses can only be associated with life insurance products.

A bonus is generally accrued by the insurance provider every year but it is only provided to the insured or the nominees of the insured in the event of maturity of the policy or in case of unfortunate death of the insured.

A bonus is not paid apart from these two situations under a life insurance policy contract.

Under life insurance policy contract, insurer provides protection and coverage from several risks for which insured has to pay insurance premium to the insurer. Insurance premium is dependent on many factors like the age of the person, coverage provided by the policy and tenure of the coverage.

In India, insurance products are just considered as an instrument to save tax but you must understand its importance as a wealth maximisation instrument as well.

A premium paid by policyholders to the insurance companies generates revenue for a policyholder acting as a source of bonuses as well.

The premiums paid by policyholders are pooled within life insurance company’s fund and then invested in order to pay out claims and bonuses. Bonuses are offered on traditional plans which are built into the plan structure. But as more and more innovative products are introduced in the market, people have started expecting to reap more benefits from life insurance products.

Unit linked insurance plan is one such insurance product which provides dual benefit of insurance and investment. Money parked in this form of life insurance not only protects from risks but also act as a source of wealth maximisation.

The insurance premium is pooled by the insurance company and invested into government securities including debt instruments and equity markets in order to generate revenues for the investor. Generally, the insurance companies invest funds as per predefined structures.

Here are few forms of bonuses offered by insurance companies:

-

Simple reversionary bonus (SRB)

This type of bonus is the basic form of bonus provided with every traditional plan. This type of bonus is only calculated on the sum assured. It is generally declared annually and is accrued to be paid out at a time of maturity or the claim. -

Compound reversionary bonus (CRB)

As the name suggests, the main difference between simple bonus and compound bonus is the compounding factor. Compound reversionary bonus is calculated as a percentage of sum assured and is calculated taking into account previously accrued bonuses. The bonus of each and every year is added to the sum assured and next subsequent bonuses are calculated on the added amount. -

Terminal bonus

Terminal bonus is not a necessary form of bonus provided by the insurance company and is provided at sole discretion of the provider. This form of bonus is provided at the time of maturity or death of the life insured. It may be given to the policyholder after staying in the policy for a specific amount of time. -

Interim bonus

Interim bonus is paid by the insurance company for a period falling between two annual declaration dates. It is paid for the policies that mature or result in a death claim in between two bonus declaration dates. - Interim bonus is added on a pro-rata basis using interim rates declared by the company.

-

Cash bonus

Cash bonus is the only bonus paid on yearly basis to the policyholder. This form of bonus is generally given in cash and is paid at the end of the year.

Insurance companies lure perspective insurance seekers with lot of bonus promises but an individual must compare various policies so as to buy the policy meeting all your requirements.

One can compare life insurance policies with the help of insurance aggregators as they provide comparison tools and calculators to perform comparisons. Comparison of insurance policies not only help you buy insurance policies with higher bonus values but also help you buy policies within your budgets as well.