All Newsletters

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

eServe Newsletter August 2012

Fraudsters luring buyers with promises of bonus

Babar Zaidi Aug 6, 2012, 05.30AM IST

Ten seconds is all that Vijay Sharma gives a telemarketeer. But since the call was from the insurance regulator's office, he didn't disconnect it abruptly. Instead, he put everything else on hold and listened intently. "I am calling from the service management department of the Irda. You are losing money on your Ulips because the bonus that accrued on them has gone to the agent," the caller explained . "If you want, it can be refunded to your account."

Be on your guard if you get such fake calls with bogus promises. Fraudsters posing as Irda employees are luring customers with promises of bonus on their existing insurance policies if they buy a new plan. The well-oiled racket has managed to sell an estimated 4,000 policies to gullible buyers in the past one year. "In the first quarter of 2012-13 alone we have received over 1,000 complaints relating to these fraudulent calls," says Irda chairman J. Hari Narayan.

The modus operandi of these scamsters are similar to those used in Nigerian scams and lottery frauds. Some tell the victim that a big bonus has been declared on his existing policy but to get the money he must buy a new plan directly from Irda. Others lure buyers by saying that their policies have been chosen for a bonus payment through a random draws.

Click here to read full article.

LIC Jeevan Anand: Extended cover, additional accident benefit a big draw

Bakul Chugan Tongia, ET Bureau Jul 30, 2012, 12.46AM IST

Product Details:

Product Details:

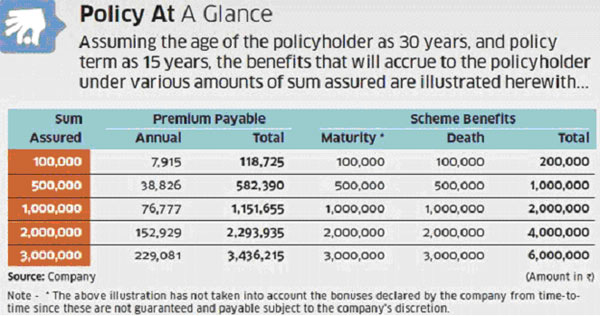

Jeevan Anand, from LIC, is an endowment-cum-whole life plan, wherein the policy continues to cover the life of the policyholder even after maturity, until his/her death.

The scheme also provides for an additional accident benefit where an additional sum assured (subject to a maximum of Rs 5 lakh) is payable to the nominee in the event of the death of the policyholder due to accident up to 70 years of age. In case of permanent disability of the policyholder due to accident, this additional sum assured shall be paid in installments.

Additional Features:

The policyholder, on maturity, is entitled to the amount of sum assured along with vested bonuses that may have been declared by the company from time-to-time. However, as the policy continues even after maturity, the entire amount of sum assured shall again be payable to the nominee on the death of the policyholder. The scheme thus factually pays double the amount of the sum assured.

Our View:

Payment of the sum assured, on maturity as well as on the death of the policyholder, is the unique selling point (USP) of this scheme, while the additional accident benefit is also impressive. Jeevan Anand thus makes up for an interesting insurance-cum-investment plan that assures payment of the sum assured twice - once to the insured and later to the nominee.

The only hitch here is that in the event of the death of the policyholder before the end of the policy term, the sum assured shall be paid just once, to the nominee, along with the vested bonuses.