All Newsletters

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

eServe Newsletter July 2013

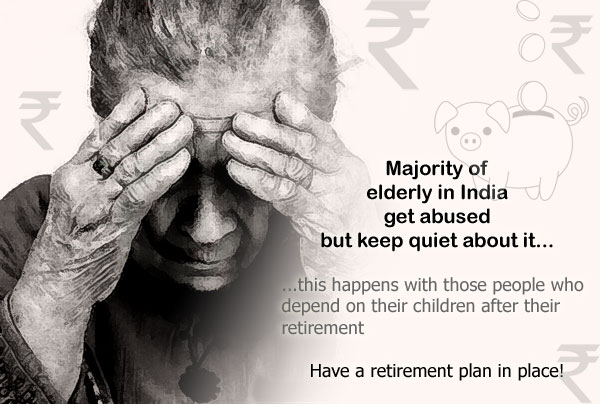

According to a recent study almost 75% of the elderly people in our country get abused regularly by their sons, daughters and daughter-in laws. Changing cultural values, lack of time and money, busy lifestyles are all contributing to a major shift in the family values. More and more elders are left to take care of themselves and even abused both physically and verbally by their own children and daughter in laws. In most cases this happens with those people who depend on their children after their retirement for their day to day needs. People who are financially independent mostly do not face such problems.

Why regular income is important after retirement?

Increasing age also brings increasing health problems and huge associated treatment costs.

Rising inflation also means a rise in cost of living due to increase in day to day expenses.

If you do not have a retirement plan in place, it is just the right time to get in touch with your insurance advisor who can help you to choose the correct retirement plan.

A retirement plan which provides you with a guaranteed regular income can help you to remain financially independent and live with self respect.

Does your family know about your life insurance policies?

Mohan’s father passed away recently due to a heart attack. Neither Mohan nor his family members were aware of the fact that his father had a whole life insurance policy worth 30 lakhs. One day while searching house for some papers, Mohan came across a premium receipt of a life insurance policy paid by his father. Just like Mohan, there are lakhs of people in our country who do not know about life insurance policies taken by their loved ones when they were alive. As a result many life insurance policies are never claimed. According to a petition filed by the Society for Consumers and Investors Protection, a registered society of investors, the unclaimed deposits lying with 24 insurance companies amounted to over Rs 4,453.27 crores as on March 2012. Life insurance policy is an important tool to protect one’s family financially in the event of the policyholder’s death. This objective remains unfulfilled when a policy remains unclaimed by the nominee due to lack of awareness of the existence of policy. Hence it makes sense to tell your spouse/dependents about the life insurance policies taken by you. Also it would be advisable to write down the details of your policies in a dairy or in a file on your computer where your spouse/dependents will be able to access it when required.

Important things to do after purchasing adequate life insurance

- Tell your spouse/dependents about it

- Keep a written record of your policies in a diary which can be accessed by your dependents when required

- Keep your policy in safe place

From Oct, service tax to make LIC policies pricier

read article >>>

Retirees need not shun risk

read article >>>

Utkarsha June 2013

read article (PDF 384KB) >>>

In simple words: Changes in advance premium as per new IRDA regulations 2013

24-Jun-2013 | Source : Magicgyan Team Changes in advance premium applicable to unit linked and non-unit linked insurance products as per new IRDA regulations 2013. Changes in advance premium:

Source: IRDA circular dated 20/6/2013 |

LIC gears up to achieve growth target after FM report card

25-Jun-2013 | Source : Moneycontrol.com According to sources finance minister P Chidambaram visited LIC's Mumbai office in May month and handed over a list of about 20 strategic changes to be made in the organisation to achieve a desired year-end target of about Rs 33,000 crore. The changes include refurbishing of marketing processes, a change in the investment strategy and also changes in the products on offer. |

Group health insurance product re-filing deadline extended

24-Jun-2013 | Source : IRDA IRDA has extended the deadline for re-filing of group health insurance products of life, non-life and health insurance companies to September 30 from the earlier deadline of June 30. As per regulations for the health insurance issued by IRDA in February, health insurance products which were non-compliant with the regulations were to be withdrawn from July 1 (group products) and October 1 (individual products). |